The state of the clinical trial supply chain: what you need to know

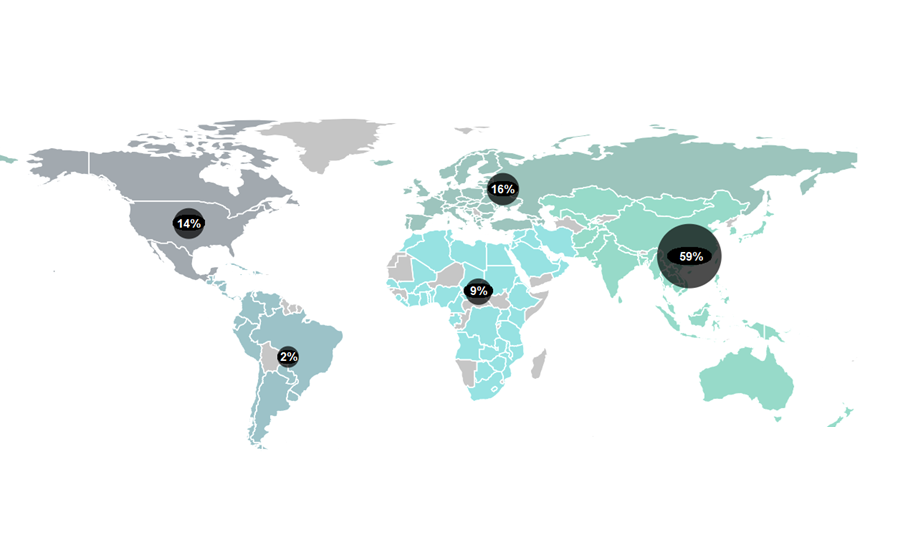

According to GlobalData’s pharmaceutical intelligence centre, 25,078 clinical trials were underway in the period between January and November 2023. These trials comprise over 11,000 companies, 15,000 new drugs and more than 16,000 trial sites. It is an exciting time to be in the clinical trials world.

Governments are vying to turn their countries into clinical trial hubs. For example, the UK announced it would allocate £121 million to expedite trials earlier in 2023 – part of a broader £643 million investment for growth and job creation in the country’s 10-year Life Sciences Vision. The European clinical trials market, valued at USD $12.2 billion in 2021, could achieve a compound annual growth rate (CAGR) of 5.7% between 2022 to 2030 according to some estimates. Growing demand for personalised medicines, spurred by substantial research funding, is encouraging existing markets to expand and new ones to open up.

This optimism is unlikely to abate any time soon – but there are reasons for caution among business decision makers. Economic fluctuations of the past two years have forced re-evaluation among some pharmaceutical big hitters. Elsewhere, emerging therapies are disrupting the sector – industry behemoths of tomorrow may be unrecognisable compared to the dominant firms today. And calls for more sustainable practices are growing louder all the time.

Against this backdrop, a foundation for a profitable and stable future for clinical trials remains constant – in the form of supply chains. Optimising them will be crucial as industry leaders pursue ground-breaking healthcare solutions. Those with the most efficient clinical trial supply chains will be best placed to create value while weathering uncertainty in the years ahead.

Clinical trial supply chains: the major dynamics

Fluctuations in raw material, energy and labour costs represent a major dynamic that clinical trial operators have been getting to grips with over recent months. The pharmaceutical market, where tight drug pricing regulations reign, faces particular pressures due to persistently high inflation rates. It means that operators face the same rising costs as other industries, but are restricted in their ability to pass these rises onto consumers.

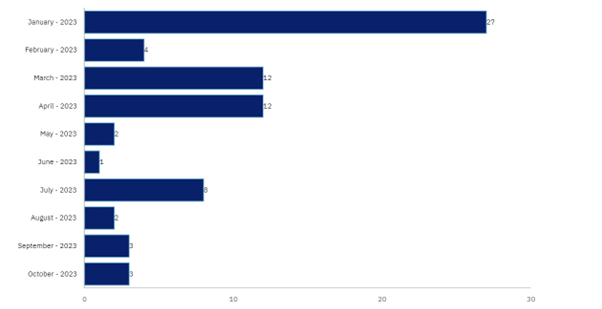

According to GlobalData, except for the US, the prices of branded drugs in major markets such as Japan, Germany, Australia, Spain, and France have fallen by an average of between 2% and 9% from 2017 to 2021. This will have major knock-on effects for the ability of pharma firms to venture into novel areas of clinical exploration – particularly for riskier therapies where the chance of failure across clinical trial phases is higher. Clinical trial terminations have petered out over the course of 2023 according to GlobalData’s pharmaceutical intelligence centre. But the high rate of terminations earlier in the year highlights how business instability can bleed into the clinical trial world.

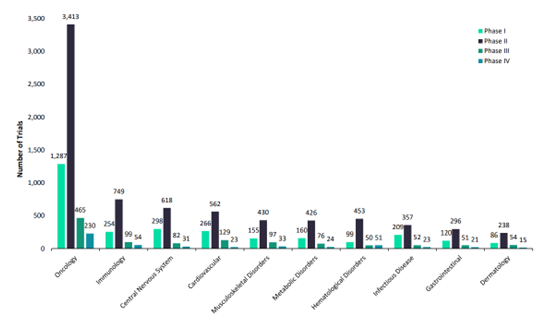

Another major dynamic confronting clinical trial supply chains relates to strides of progress in innovative therapeutic areas. Research from McKinsey signals a seismic shift in the clinical trial landscape, with cell and gene therapies projected to surge from 16 percent of product launches in 2021 to an anticipated 36 percent by 2025. Despite their growing importance, a recent survey indicated that under half of senior clinical drug supply leaders are confident in their ability to supply clinical trials for these cutting-edge therapies.

Yet the Covid-19 pandemic highlighted that the potential of novel therapies, like mRNA, are only just being realised. Constituting six out of 13 approved Covid-19 vaccines and boosters across the world’s major pharmaceutical markets – the US, UK, France, Germany, Italy, Spain, and Japan – the technology’s versatility could have myriad applications in the coming years. For example, GlobalData projections suggest the worldwide market for mRNA-based oncology therapies could exceed $2 billion by 2028, with dozens of new anti-cancer treatments currently in development. This could mean personalised cancer therapies, with early clinical studies indicating that mRNA treatment platforms can induce cancer-specific cytolytic activity. The promise is huge – but supply chains will have to adapt.

And supply chain evolution doesn’t stop there. With almost half of clinical trials contributing to 20% of the UK National Health Service’s carbon footprint, sustainability initiatives continue to gather pace in the pharmaceutical industry. Waste and emissions throughout the clinical trial pipeline are in the spotlight for their environmental impact. In one study, emissions attributed to 350,000 national and international trials were assessed as equivalent to 27.5 million tons of greenhouse gas emissions – more than 30% of the total released by the nation of Bangladesh.

One response from industry has been trial decentralisation. The Covid-19 pandemic revealed the feasibility of these trials, accelerating their popularity; decentralised clinical trials (DCTs) rose from 250 trials in 2012 to 1,291 trials in 2021. But this means making clinical trial supply chains even more robust. Stakeholders demand tech-driven solutions to reduce waste and environmental impact – while constantly shoring up clinical trial quality in an era of personalised medicine and DCT testing.

Novel platforms to the rescue

Pharmaceutical companies navigating the complex web of clinical trial supply chains are finding solutions in digital transformation. Controlant’s Aurora platform – based on real-time visibility right down to the product level – offers a pioneering approach to distribution throughout the clinical trial supply chain, and is already being harnessed by leading pharmaceutical firms.

Supply chain monitoring platforms based on real-time visibility are able to meticulously track shipments from origin sites to medical hubs. They can monitor timings, temperatures and other variables to provide unprecedented insight into supply chain performance – allowing comprehensive oversight in the present and seamless planning for the future.

Ada Pálmadóttir, VP of Business Development at Controlant, explains, “Once you have the necessary information for a specific process, you can explore its potential applications. Our customers are discovering new areas where they can benefit from connecting and combining information within our system, enabling greater automation.”

Use of live and predictive analytics also makes adapting to an age of decentralisation easier than ever before. Researchers gain confidence through data-driven decision-making capabilities, and can automate supply chain performance based on validated real-time data.

Furthermore, choosing an experienced partner can make navigating the shifting supply chain landscape easier than ever. Controlant’s platform enables pharma companies to ensure compliance with local regulatory standards, with real-time insights to ensure these standards are consistently met.

The combination of predictive analytics and assured compliance is a powerful one. It gives pharmaceutical firms a platform to ensure their clinical trial supply chains are optimised for efficiency and sustainability. Analysis from WBR Insights suggests over 58% of pharma suppliers lack comprehensive visibility over their supply chains – and as much as 74% when looking at specific tiers of the supply chain. The critical role of platforms like Aurora is to offer this visibility, enabling continuous improvement and collaboration via digitalisation and IoT technology – making hitting sustainability targets more achievable than ever.

One of the ground-breaking features of Aurora is Product Stability Automation (PSA). It moves from generic shipment-based temperature monitoring to product-specific stability profiles. In doing so, it simplifies product release processes, reduces the need for manual intervention and practically eliminates the possibility of human error. Without PSA, pharma companies working with Controlant can typically bring manual inspection down to within 10%. Results from Controlant’s 12-month pilot project indicate that with PSA, manual interventions can be reduced even further, from 10% of shipments to just 0.5%. With decentralisation and personalisation making supply chains more granular than ever, this kind of control gives innovative pharmaceutical firms the power they need to adapt.

In a landscape where real-time decision-making, regulatory compliance and sustainability are paramount, and in a race to be first to market, pharmaceutical companies face novel challenges and need to optimise every step of the way. But novel technology is arriving too, helping them to navigate clinical trial supply chain challenges with precision and efficiency. Many industry trailblazers are already overhauling their clinical trial supply chains with the benefits the Aurora platform offers. Download the whitepaper on this page to find out how it could benefit you too.

Source link

#state #clinical #trial #supply #chain