Over 2,000 drugs in Japan undergo an average price reduction of 9.4% in April

©GlobalData

As of 1 April 2023, Japan’s latest ‘off-year’ National Health Insurance (NHI) drug price revisions for FY2023 have now come into effect. While roughly 100 drugs received additional price premiums, the majority of products saw their price reduced as a result of discrepancies between their NHI and market prices.

GlobalData, therefore, reviews the impact these price changes have on the Japanese market by comparing the recent NHI-related price adjustments against the manufacturer price changes of all drugs on the Japanese market in April.

Japan’s MHLW utilises off-year price revisions as method of NHI cost savings

Historically, Japan performs scheduled biannual price adjustments as a cost-reduction method but recently there have been additional adjustments in the years in between, with FY2023 being one of these years of off-year price revisions and the fifth year of consecutive drug price reductions.

In December 2022, the Ministry of Health, Labour and Welfare’s (MHLW) proposal was approved for the FY2023 off-year price revisions, which stipulated that drugs with price discrepancy rates between their NHI prices and their market prices in excess of 0.625 times the average price discrepancy rate in 2022 would receive revisions. In other words, NHI-listed products with more than a 4.375% rate of price discrepancy would face an off-year price reduction or price increase. These changes have now come into effect as of 1 April 2023.

Japanese MHLW’s new NHI drug price revisions for FY2023 account for 36% of products receiving price increases in April 2023

As part of the new revision, two special measures were introduced to ensure a stable drug supply by either maintaining or increasing the listed prices of designated drugs. These special repricing rules broaden the scope of innovative drugs eligible for receiving premiums and resulted in 143 products receiving additional premiums while another 90 drugs were able to maintain their price under regular price maintenance premiums (PMP) rules. The second measure is specifically applied to unprofitable drugs, allowing upward price adjustments in the latest price revisions. For example, the antibiotic cefazolin increased its manufacturer price on average by 19% across all packs in April compared to its price in March (see Figure 1).

While 143 products did receive direct price increases related to the FY2023 price revision special measures, an additional 240 products saw their prices increase in April. Therefore, an average price increase of nearly 29% across these brands was seen in April, with only 36% of products having price increases being accounted for by the FY2023 price revision special measures. Although these are significant price increases, it accounts for only a small amount of the Japanese market, as 91% of products saw no change or suffered price cuts this month.

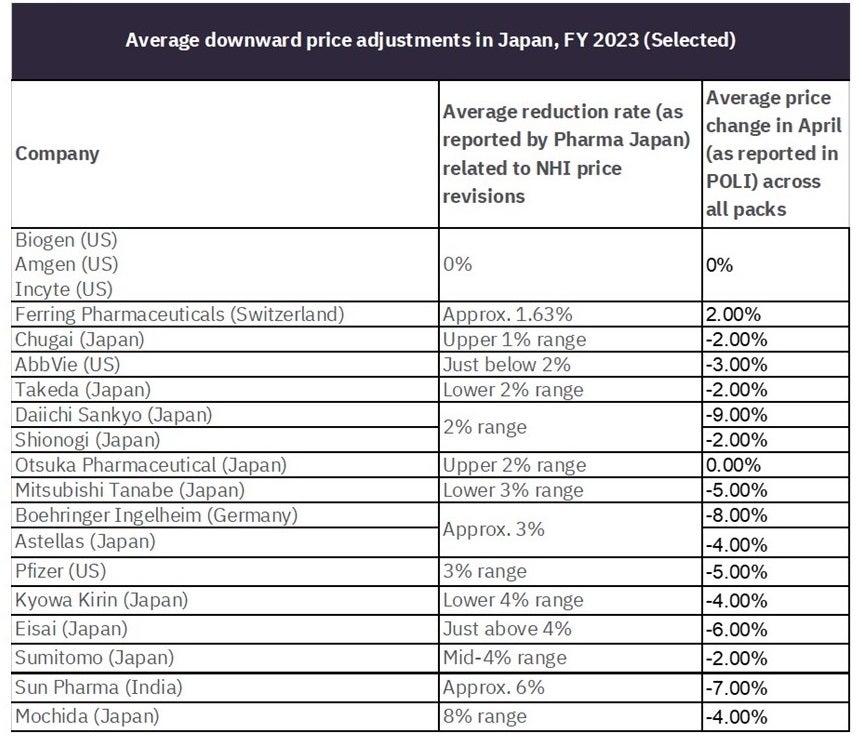

Key companies impacted by price cuts saw reductions ranging between 2.0% and 8.0% in April, including NHI-related price reductions

More than 2,000 medicines saw reductions in Japan in April. In a recent survey by Jiho, manufacturers were surveyed on the expected impact of the NHI price revisions, with three US companies (Biogen, Amgen, and Incyte) reporting they would not be affected by their marketed treatments. This finding can be confirmed with none of the products under these companies undergoing price changes so far in April. A follow-up survey of 57 drug manufacturers expected the average NHI price reduction to range between 1% and 4% for top-tier and second-tier manufacturers.

For example, Ferring Pharmaceuticals (Switzerland) reported a downward pressure of roughly 1.63%. Upon reviewing the data in GlobalData’s POLI database, six of Ferring’s brands received price changes in April, with only human menopausal gonadotrophin receiving a price increase. This product is genericised while patent-protected versions of the drug received a price decrease of 4.7%. It is worth noting that because of Ferring’s human menopausal gonadotrophin price increases, the average price change for the company was a price increase of 2.0% at the brand level in April. The table below summarises the average downward pressure key companies received as part of the NHI price revisions against the average price change across all packs for the designated companies in April.

Table 1: Comparison of companies’ average NHI-related price adjustments vs. average price change in April

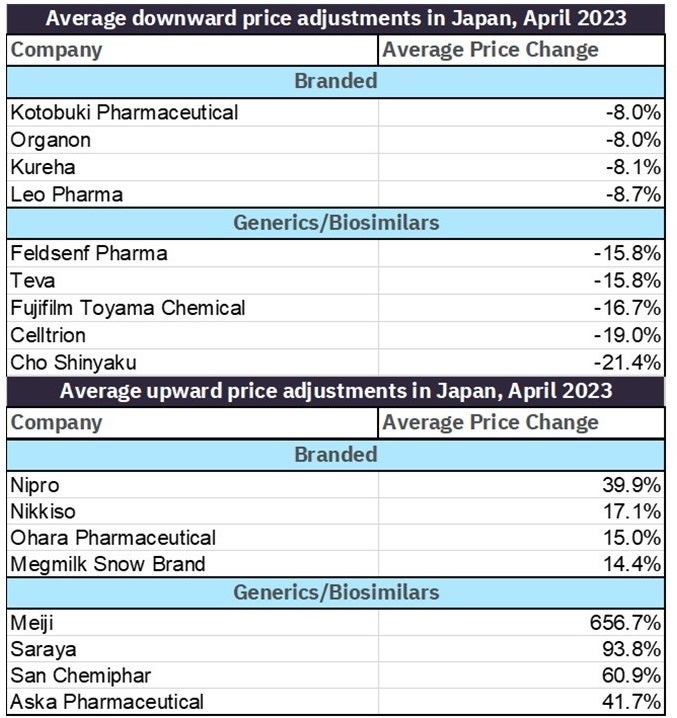

A comparison of branded drug price changes against generics, branded generics, and biosimilars shows those companies hit hardest by price cuts in April. Companies whose patented-protected products were hit hardest underwent average price reductions between 8% and 9% while companies whose generic products were worst off saw price decreases between 15% and 22%. Despite it appearing that companies with large generic/biosimilars portfolios were in general harder hit, it should be mentioned that companies’ generic products also saw some of the greatest price increases in April, ranging from 40% to over 600%.

Table 2: Top average price changes for branded vs. generics/biosimilars by company in April 2023

While the newly introduced measures were able to maintain or increase drug prices for a small percentage of designated drugs, it is unlikely that special pricing measures for unprofitable drugs will continue in FY2024, as claimed already by the MHLW as part of discussion topics for FY2024 price revisions. This factor will only heighten the already strong criticism by industry representatives of the government on the frequency of price adjustments. It is likely that any further reform will only increase the expected pricing pressure on pharmaceuticals.

Source link

#drugs #Japan #undergo #average #price #reduction #April