High interest rates will reduce investment in pharma contract manufacturers

Pharma manufacturers will likely be unable to invest as much in innovative capabilities as they did previously due to the current environment of high inflation and quickly rising interest rates. Instead, many manufacturers will refocus on operational efficiency in the coming months. During a time when increasingly innovative biologics are being approved and pharma companies are seeking contractors to mitigate the risk of supply chain disruptions, the long-term effects of slowing investment could significantly hinder global pharma manufacturing.

The current situation discourages investment and provides challenges for private equity (PE) firms. Contract manufacturing organisations (CMOs) that invested in improving their capabilities in recent years are now stuck with debt that is comparatively more costly, as variable interest rates have increased for loans. In some cases, the rising cost of capital will cause firms to restrict plans to upgrade their facilities. Generally, it becomes more difficult to add value to PE-owned companies during times of high interest rates, lessening their profitability. In an interview with the Financial Times, financial consultancy practice NextWealth’s managing director Heather Hopkins said: “Higher interest rates may indeed prove challenging for private equity-backed consolidators. The rising cost of capital could mean some firms pull back from acquisitions and focus more on operational efficiency.”

Most of the top five (by contract revenue) public-dedicated CMOs reduced their debt-to-equity ratios during 2017–22, apart from Samsung Biologics (Incheon, South Korea) and Siegfried Holding (Zofingen, Switzerland). These CMOs showed an increasing reluctance to take on debt even before the rising inflation and interest rates seen last year, perhaps due to taking a more cautious approach during the uncertain business environment caused by the Covid-19 pandemic. GlobalData expects debt-to-equity ratios to fall further in 2022, as the cost of borrowing has increased substantially. A good debt-to-equity ratio is less than 0.6, which the majority of the top five CMOs had last year. Investors typically search for a company debt ratio between 0.3 and 0.6.

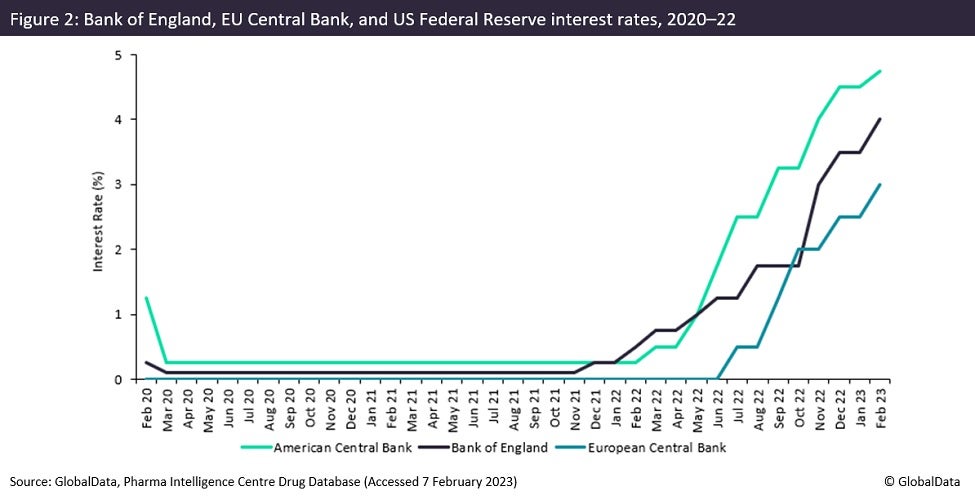

Interest rates remained low during the early Covid-19 pandemic years (2020–21) in Europe, the UK and the US, as many industries struggled during lockdowns, which made borrowing comparatively cheap. On 24 February last year, Russia invaded Ukraine, which in turn significantly added to inflationary pressures due to higher goods and energy prices, as well as bottlenecks in supply chains. Following February 2022, a sharp increase in base rates was observed as banks sought to curb inflation by slowing economic activity. As a consequence, loans became less attractive for businesses to acquire.

Due to higher food and energy costs, many employees have demanded higher wages and companies have been hit with greater overhead costs. Funding improvements to businesses are now also going to be comparatively more costly than in previous years. All of these factors, combined with more costly borrowing, have provided major challenges for companies.

Source link

#High #interest #rates #reduce #investment #pharma #contract #manufacturers